Finance That Moves with You Anytime, Anywhere

Fintech is your all-in-one financial platform. Save, invest, and grow smarter across web and mobile — securely and effortlessly.

Trusted by leading companies

Fintech is a AI powered platform to provide suggestions. There can be flaws in the system so take decisions at your own risk.

Your Financial Partner in 3 Easy Steps

Create your account

Email Address

Password

Get Started

Sign Up in Minutes

Create your Fintech account anywhere on web or mobile.

Create your account

Email Address

Password

Get Started

Sign Up in Minutes

Create your Fintech account anywhere on web or mobile.

Create your account

Email Address

Password

Get Started

Sign Up in Minutes

Create your Fintech account anywhere on web or mobile.

Savings

$100

$600

Investments

$10

$250

Expenses

$100

$500

Set Your Financial Goals

Customize your savings, investments, spendings and tracking.

Savings

$100

$600

Investments

$10

$250

Expenses

$100

$500

Set Your Financial Goals

Customize your savings, investments, spendings and tracking.

Savings

$100

$600

Investments

$10

$250

Expenses

$100

$500

Set Your Financial Goals

Customize your savings, investments, spendings and tracking.

Add 50% of food budget, whenever you don’t order

Increase SIP from $500/month to $700/month

Move account balance to short term FD

Move 20% savings to low-risk to balance risk

Moev 20% savings to low-risk to balance risk

Moev 20% savings to low-risk to balance risk

Add 50% of food budget, whenever you don’t order

Increase SIP from $500/month to $700/month

Move account balance to short term FD

Move 20% savings to low-risk to balance risk

Apply for IPO with 15% plus GMP

Use 5% of your salary in the mutual funds and stocks

Grow Your Wealth

Monitor your financial growth with AI-powered insights with us.

Add 50% of food budget, whenever you don’t order

Increase SIP from $500/month to $700/month

Move account balance to short term FD

Move 20% savings to low-risk to balance risk

Moev 20% savings to low-risk to balance risk

Moev 20% savings to low-risk to balance risk

Add 50% of food budget, whenever you don’t order

Increase SIP from $500/month to $700/month

Move account balance to short term FD

Move 20% savings to low-risk to balance risk

Apply for IPO with 15% plus GMP

Use 5% of your salary in the mutual funds and stocks

Grow Your Wealth

Monitor your financial growth with AI-powered insights with us.

Add 50% of food budget, whenever you don’t order

Increase SIP from $500/month to $700/month

Move account balance to short term FD

Move 20% savings to low-risk to balance risk

Moev 20% savings to low-risk to balance risk

Moev 20% savings to low-risk to balance risk

Add 50% of food budget, whenever you don’t order

Increase SIP from $500/month to $700/month

Move account balance to short term FD

Move 20% savings to low-risk to balance risk

Apply for IPO with 15% plus GMP

Use 5% of your salary in the mutual funds and stocks

Grow Your Wealth

Monitor your financial growth with AI-powered insights with us.

Powerful Features, Seamlessly Connected

Index Fund SIP

Track Nifty 50 and grow with the market over long term.

Moderate

Risk

11%

Return

5+ Yrs

Time

Invest Now

Low-Cost InvestingSIP

Save more with minimal fees, thanks to passive management.

Diversified Portfolio

Get exposure to top-performing companies in a single fund.

Market-Linked Growth

Grow with the index—benefit from India’s long-term economic rise.

Smart Investments

Personalized plans tailored for your secured future investments.

Index Fund SIP

Track Nifty 50 and grow with the market over long term.

Moderate

Risk

11%

Return

5+ Yrs

Time

Invest Now

Low-Cost InvestingSIP

Save more with minimal fees, thanks to passive management.

Diversified Portfolio

Get exposure to top-performing companies in a single fund.

Market-Linked Growth

Grow with the index—benefit from India’s long-term economic rise.

Smart Investments

Personalized plans tailored for your secured future investments.

Index Fund SIP

Track Nifty 50 and grow with the market over long term.

Moderate

Risk

11%

Return

5+ Yrs

Time

Invest Now

Low-Cost InvestingSIP

Save more with minimal fees, thanks to passive management.

Diversified Portfolio

Get exposure to top-performing companies in a single fund.

Market-Linked Growth

Grow with the index—benefit from India’s long-term economic rise.

Smart Investments

Personalized plans tailored for your secured future investments.

Fixed Weekly Save

Save $10 every Friday

Round-Up Rule

Round up every spend to the nearest $10/$20 and save the change

Spending Challenge

Save $50 each day you don’t order food or shop online

Market Dip Save

Invest $100 automatically when stock market drops 1% or more

End-of-Week Sweep

Save leftover money from your weekly budget

Payday Save

Auto-save a fixed percentage or amount every time salary is credited

Fixed Weekly Save

Save $10 every Friday

Round-Up Rule

Round up every spend to the nearest $10/$20 and save the change

Spending Challenge

Save $50 each day you don’t order food or shop online

Market Dip Save

Invest $100 automatically when stock market drops 1% or more

End-of-Week Sweep

Save leftover money from your weekly budget

Payday Save

Auto-save a fixed percentage or amount every time salary is credited

Auto-Saving Rules

Intelligent savings based on your investments behavior.

Fixed Weekly Save

Save $10 every Friday

Round-Up Rule

Round up every spend to the nearest $10/$20 and save the change

Spending Challenge

Save $50 each day you don’t order food or shop online

Market Dip Save

Invest $100 automatically when stock market drops 1% or more

End-of-Week Sweep

Save leftover money from your weekly budget

Payday Save

Auto-save a fixed percentage or amount every time salary is credited

Fixed Weekly Save

Save $10 every Friday

Round-Up Rule

Round up every spend to the nearest $10/$20 and save the change

Spending Challenge

Save $50 each day you don’t order food or shop online

Market Dip Save

Invest $100 automatically when stock market drops 1% or more

End-of-Week Sweep

Save leftover money from your weekly budget

Payday Save

Auto-save a fixed percentage or amount every time salary is credited

Auto-Saving Rules

Intelligent savings based on your investments behavior.

Fixed Weekly Save

Save $10 every Friday

Round-Up Rule

Round up every spend to the nearest $10/$20 and save the change

Spending Challenge

Save $50 each day you don’t order food or shop online

Market Dip Save

Invest $100 automatically when stock market drops 1% or more

End-of-Week Sweep

Save leftover money from your weekly budget

Payday Save

Auto-save a fixed percentage or amount every time salary is credited

Fixed Weekly Save

Save $10 every Friday

Round-Up Rule

Round up every spend to the nearest $10/$20 and save the change

Spending Challenge

Save $50 each day you don’t order food or shop online

Market Dip Save

Invest $100 automatically when stock market drops 1% or more

End-of-Week Sweep

Save leftover money from your weekly budget

Payday Save

Auto-save a fixed percentage or amount every time salary is credited

Auto-Saving Rules

Intelligent savings based on your investments behavior.

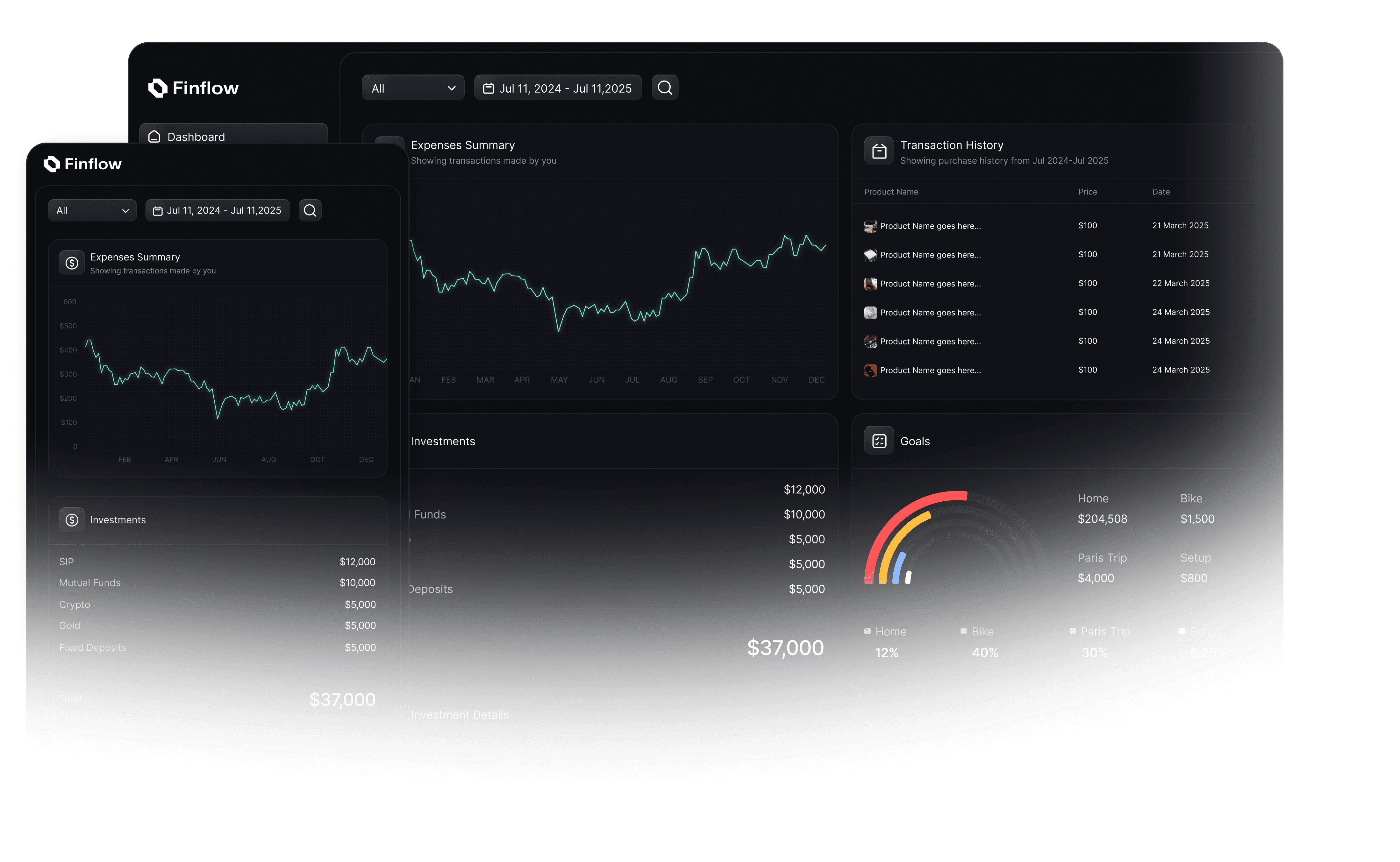

Spend & Goal Analytics

Visualize your money movement like never before with us.

Spend & Goal Analytics

Visualize your money movement like never before with us.

Spend & Goal Analytics

Visualize your money movement like never before with us.

Cross-Platform Sync

Your finances in sync with all devices — desktop, tablet, and mobile.

Cross-Platform Sync

Your finances in sync in all devices — desktop, tablet, and mobile.

Cross-Platform Sync

Your finances in sync with all devices — desktop, tablet, and mobile.

Designed for the Modern Investors

Secure Global Cloud Access

Always protected, always accessible system

Secure Global Cloud Access

Always protected, always accessible system

Secure Global Cloud Access

Always protected, always accessible system

Mobile-Optimized Dashboard

Experience smooth performance on every device

Mobile-Optimized Dashboard

Experience smooth performance on every device

Mobile-Optimized Dashboard

Experience smooth performance on every device

Personalized AI Bot Support

Receive insights tailored uniquely for you

Personalized AI Bot Support

Receive insights tailored uniquely for you

Personalized AI Bot Support

Receive insights tailored uniquely for you

Proactive Customer Support

Real humans, real quick responses all day

Proactive Customer Support

Real humans, real quick responses all day

Proactive Customer Support

Real humans, real quick responses all day

Trusted by Thousands Worldwide

Sophie L.

Graphic Designer

Fintech made managing my money feel effortless. I finally have saving, investing, and budgeting all in one place — and it actually looks good!

Mateo R.

Financial Consultant

Security was my top concern, but Fintech’s encryption and authentication features gave me peace of mind from day one.

Anders M.

Product Manager

The UI is clean, intuitive, and fast — whether I’m on my desktop or mobile. It actually makes me want to check in on my finances.

Luca B.

Tech Entrepreneur

I used to juggle three different apps for tracking finances. With Fintech, I just need one. Everything syncs perfectly between my phone and laptop.

Emilia W.

University Student

Fintech’s smart budgeting tools helped me hit my savings goal three months early. It’s like having a personal finance coach in my pocket.

Kenji S.

Freelancer

I travel often, and Fintech helps me manage my accounts from anywhere. It’s secure, responsive, and always up to date.

Hana K.

Data Analyst

The investment tools are powerful but simple. I’ve seen real growth in my portfolio without feeling overwhelmed.

Isabelle D.

Business Owner

With Fintech, I finally feel in control of my money. I can track my net worth, automate my savings, and even invest with confidence.

Ana M.

Content Strategist

What used to be a chore now feels empowering. Fintech turned my financial stress into strategy.

Sophie L.

Graphic Designer

Fintech made managing my money feel effortless. I finally have saving, investing, and budgeting all in one place — and it actually looks good!

Luca B.

Tech Entrepreneur

I used to juggle three different apps for tracking finances. With Fintech, I just need one. Everything syncs perfectly between my phone and laptop.

Hana K.

Data Analyst

The investment tools are powerful but simple. I’ve seen real growth in my portfolio without feeling overwhelmed.

Mateo R.

Financial Consultant

Security was my top concern, but Fintech’s encryption and authentication features gave me peace of mind from day one.

Emilia W.

University Student

Fintech’s smart budgeting tools helped me hit my savings goal three months early. It’s like having a personal finance coach in my pocket.

Isabelle D.

Business Owner

With Fintech, I finally feel in control of my money. I can track my net worth, automate my savings, and even invest with confidence.

Anders M.

Product Manager

The UI is clean, intuitive, and fast — whether I’m on my desktop or mobile. It actually makes me want to check in on my finances.

Kenji S.

Freelancer

I travel often, and Fintech helps me manage my accounts from anywhere. It’s secure, responsive, and always up to date.

Ana M.

Content Strategist

What used to be a chore now feels empowering. Fintech turned my financial stress into strategy.

Sophie L.

Graphic Designer

Fintech made managing my money feel effortless. I finally have saving, investing, and budgeting all in one place — and it actually looks good!

Mateo R.

Financial Consultant

Security was my top concern, but Fintech’s encryption and authentication features gave me peace of mind from day one.

Anders M.

Product Manager

The UI is clean, intuitive, and fast — whether I’m on my desktop or mobile. It actually makes me want to check in on my finances.

Luca B.

Tech Entrepreneur

I used to juggle three different apps for tracking finances. With Fintech, I just need one. Everything syncs perfectly between my phone and laptop.

Emilia W.

University Student

Fintech’s smart budgeting tools helped me hit my savings goal three months early. It’s like having a personal finance coach in my pocket.

Kenji S.

Freelancer

I travel often, and Fintech helps me manage my accounts from anywhere. It’s secure, responsive, and always up to date.

Hana K.

Data Analyst

The investment tools are powerful but simple. I’ve seen real growth in my portfolio without feeling overwhelmed.

Isabelle D.

Business Owner

With Fintech, I finally feel in control of my money. I can track my net worth, automate my savings, and even invest with confidence.

Ana M.

Content Strategist

What used to be a chore now feels empowering. Fintech turned my financial stress into strategy.

Sophie L.

Graphic Designer

Fintech made managing my money feel effortless. I finally have saving, investing, and budgeting all in one place — and it actually looks good!

Mateo R.

Financial Consultant

Security was my top concern, but Fintech’s encryption and authentication features gave me peace of mind from day one.

Anders M.

Product Manager

The UI is clean, intuitive, and fast — whether I’m on my desktop or mobile. It actually makes me want to check in on my finances.

Luca B.

Tech Entrepreneur

I used to juggle three different apps for tracking finances. With Fintech, I just need one. Everything syncs perfectly between my phone and laptop.

Emilia W.

University Student

Fintech’s smart budgeting tools helped me hit my savings goal three months early. It’s like having a personal finance coach in my pocket.

Kenji S.

Freelancer

I travel often, and Fintech helps me manage my accounts from anywhere. It’s secure, responsive, and always up to date.

Hana K.

Data Analyst

The investment tools are powerful but simple. I’ve seen real growth in my portfolio without feeling overwhelmed.

Isabelle D.

Business Owner

With Fintech, I finally feel in control of my money. I can track my net worth, automate my savings, and even invest with confidence.

Ana M.

Content Strategist

What used to be a chore now feels empowering. Fintech turned my financial stress into strategy.

Sophie L.

Graphic Designer

Fintech made managing my money feel effortless. I finally have saving, investing, and budgeting all in one place — and it actually looks good!

Mateo R.

Financial Consultant

Security was my top concern, but Fintech’s encryption and authentication features gave me peace of mind from day one.

Anders M.

Product Manager

The UI is clean, intuitive, and fast — whether I’m on my desktop or mobile. It actually makes me want to check in on my finances.

Luca B.

Tech Entrepreneur

I used to juggle three different apps for tracking finances. With Fintech, I just need one. Everything syncs perfectly between my phone and laptop.

Emilia W.

University Student

Fintech’s smart budgeting tools helped me hit my savings goal three months early. It’s like having a personal finance coach in my pocket.

Kenji S.

Freelancer

I travel often, and Fintech helps me manage my accounts from anywhere. It’s secure, responsive, and always up to date.

Hana K.

Data Analyst

The investment tools are powerful but simple. I’ve seen real growth in my portfolio without feeling overwhelmed.

Isabelle D.

Business Owner

With Fintech, I finally feel in control of my money. I can track my net worth, automate my savings, and even invest with confidence.

Ana M.

Content Strategist

What used to be a chore now feels empowering. Fintech turned my financial stress into strategy.

Sophie L.

Graphic Designer

Fintech made managing my money feel effortless. I finally have saving, investing, and budgeting all in one place — and it actually looks good!

Mateo R.

Financial Consultant

Security was my top concern, but Fintech’s encryption and authentication features gave me peace of mind from day one.

Anders M.

Product Manager

The UI is clean, intuitive, and fast — whether I’m on my desktop or mobile. It actually makes me want to check in on my finances.

Luca B.

Tech Entrepreneur

I used to juggle three different apps for tracking finances. With Fintech, I just need one. Everything syncs perfectly between my phone and laptop.

Emilia W.

University Student

Fintech’s smart budgeting tools helped me hit my savings goal three months early. It’s like having a personal finance coach in my pocket.

Kenji S.

Freelancer

I travel often, and Fintech helps me manage my accounts from anywhere. It’s secure, responsive, and always up to date.

Hana K.

Data Analyst

The investment tools are powerful but simple. I’ve seen real growth in my portfolio without feeling overwhelmed.

Isabelle D.

Business Owner

With Fintech, I finally feel in control of my money. I can track my net worth, automate my savings, and even invest with confidence.

Ana M.

Content Strategist

What used to be a chore now feels empowering. Fintech turned my financial stress into strategy.

Flexible Plans, Transparent Pricing

Get 20% off with yearly plan

Monthly

Yearly

Starter

For individuals and small teams trying out Pandabase without limits.

$11.99

$119.99

/month

Startup plan includes:

2 Campaigns

2 Team Members

Analytics

Customisable Design

AI Features

Anti-Fraud Features

Most Popular

Premium

Grow your online business with tools proven to increase.

$19.99

$199.99

/month

Premium plan includes:

10 Campaigns

10 Team Members

Advanced Analytics

Customisable Design

Advanced AI Features

Advanced Anti-Fraud Features

Pro

Scale your growing business with a comprehensive set of features.

$29.99

$299.99

/month

Pro plan includes:

Unlimited Campaigns

20 Team Members

Custom Analytics

Customisable Design

Advanced AI Features

Advanced Anti-Fraud Features

Flexible Plans, Transparent Pricing

Get 20% off with yearly plan

Monthly

Yearly

Starter

For individuals and small teams trying out Pandabase without limits.

$11.99

$119.99

/month

Startup plan includes:

2 Campaigns

2 Team Members

Analytics

Customisable Design

AI Features

Anti-Fraud Features

Most Popular

Premium

Grow your online business with tools proven to increase.

$19.99

$199.99

/month

Premium plan includes:

10 Campaigns

10 Team Members

Advanced Analytics

Customisable Design

Advanced AI Features

Advanced Anti-Fraud Features

Pro

Scale your growing business with a comprehensive set of features.

$29.99

$299.99

/month

Pro plan includes:

Unlimited Campaigns

20 Team Members

Custom Analytics

Customisable Design

Advanced AI Features

Advanced Anti-Fraud Features

Flexible Plans, Transparent Pricing

Get 20% off with yearly plan

Monthly

Yearly

Starter

For individuals and small teams trying out Pandabase without limits.

$11.99

$119.99

/month

Startup plan includes:

2 Campaigns

2 Team Members

Analytics

Customisable Design

AI Features

Anti-Fraud Features

Most Popular

Premium

Grow your online business with tools proven to increase.

$19.99

$199.99

/month

Premium plan includes:

10 Campaigns

10 Team Members

Advanced Analytics

Customisable Design

Advanced AI Features

Advanced Anti-Fraud Features

Pro

Scale your growing business with a comprehensive set of features.

$29.99

$299.99

/month

Pro plan includes:

Unlimited Campaigns

20 Team Members

Custom Analytics

Customisable Design

Advanced AI Features

Advanced Anti-Fraud Features

Your Security is Our Commitment

Bank-Level Security Encryption

256-bit SSL secure environment

Bank-Level Security Encryption

256-bit SSL secure environment

Bank-Level Security Encryption

256-bit SSL secure environment

PCI-DSS & GDPR Compliant

Global level security certifications

PCI-DSS & GDPR Compliant

Global level security certifications

PCI-DSS & GDPR Compliant

Global level security certifications

24/7 Threat Monitoring System

Always-on protection systems monitoring

24/7 Threat Monitoring System

Always-on protection systems monitoring

24/7 Threat Monitoring System

Always-on protection systems monitoring

Insurance Protection For Everything

Deposit coverage up to $6000

Insurance Protection For Everything

Deposit coverage up to $6000

Insurance Protection For Everything

Deposit coverage up to $6000

Manage Your Finances Anywhere

Fintech is available across all your favorite devices. Access anytime on mobile or web.

Frequently Asked Questions

Fintech is your all-in-one financial platform. Save, invest, and grow smarter across web and mobile — securely and effortlessly.

How secure is my data with Finflow?

Can I access Finflow on both mobile and desktop?

What happens after my free trial?

How can I upgrade or downgrade my plan?

What if I forget my password?

How secure is my data with Finflow?

Can I access Finflow on both mobile and desktop?

What happens after my free trial?

How can I upgrade or downgrade my plan?

What if I forget my password?

How secure is my data with Finflow?

Can I access Finflow on both mobile and desktop?

What happens after my free trial?

How can I upgrade or downgrade my plan?

What if I forget my password?